“The Cautious Investor’s Guide to Riding the Waves of Volatility”

In today’s fast-paced financial landscape, investors are constantly on the lookout for ways to maximize returns while minimizing risk. One increasingly popular strategy is taking advantage of the cryptocurrency market’s unique characteristics and leveraging it as a long-term investment opportunity.

At its core, investing in crypto assets means buying and holding digital currencies like Bitcoin, Ethereum, or others with the expectation that their value will appreciate over time. This can be done through various methods, including trading futures contracts on these markets.

Futures Premium: The Key to Profiting from Volatility

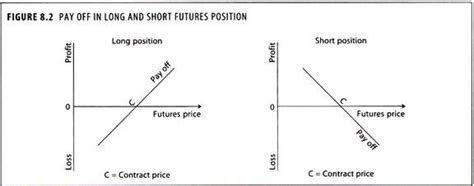

One key concept investors should understand when entering into a crypto-related long position is the idea of

futures premium, also known as the “premium” or “spread” that exists between buying and selling cryptocurrencies at different times. Futures contracts are priced based on their expected future price movement, which means they often provide a riskier investment opportunity compared to traditional assets.

In this context, investors can benefit from taking advantage of

futures premium by buying a futures contract at a lower price and selling it at a higher price later in the same period. This strategy exploits the difference between these two prices, allowing for potential profit without directly owning or trading the underlying asset.

For example, if you’re long on Bitcoin (BTC) and have purchased a futures contract with an expiration date of one month from now, you’ve paid $50 per unit for the contract. If the price of Bitcoin increases by 20% within that period, your contract will become worth $60 per unit, resulting in a potential profit of $10 per unit.

Why Crypto Asset Investment is Risky

While futures premium can provide an attractive opportunity to generate returns, it’s essential to acknowledge that crypto asset markets are inherently volatile and unpredictable. Prices can fluctuate rapidly due to various market factors, including changes in global economic conditions, regulatory decisions, or unexpected events.

This means that even if you have a solid understanding of the fundamentals and risk management strategies, investing in cryptocurrencies carries significant risks. Crypto prices can drop suddenly without warning, wiping out any gains from a long position, making it crucial for investors to be prepared for potential losses as well.

Tips for Successful Crypto Asset Investment

To maximize your chances of success when investing in crypto assets or taking advantage of futures premium:

- Understand the basics: Make sure you have a solid grasp of cryptocurrency market fundamentals, including their history, price movements, and technical analysis.

- Choose the right strategy: Decide whether you prefer to buy and hold (long position) or sell and take profits from your investment.

- Use proper risk management: Implement stop-loss orders, diversify your portfolio, and have a clear understanding of your maximum potential losses.

- Stay informed but avoid emotional decisions

: Continuously monitor market developments and adjust your strategy accordingly, but avoid making impulsive decisions based on emotions.

In conclusion, investing in crypto assets or using futures premium can be a potentially lucrative way to ride the waves of volatility, but it requires careful analysis, risk management, and a solid understanding of these markets.